Life Insurance in and around Hastings

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Hastings, MI, friends and neighbors both young and old already have State Farm life insurance!

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Put Those Worries To Rest

Life can be just as unpredictable when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific time frame, State Farm can help you choose the right policy for you.

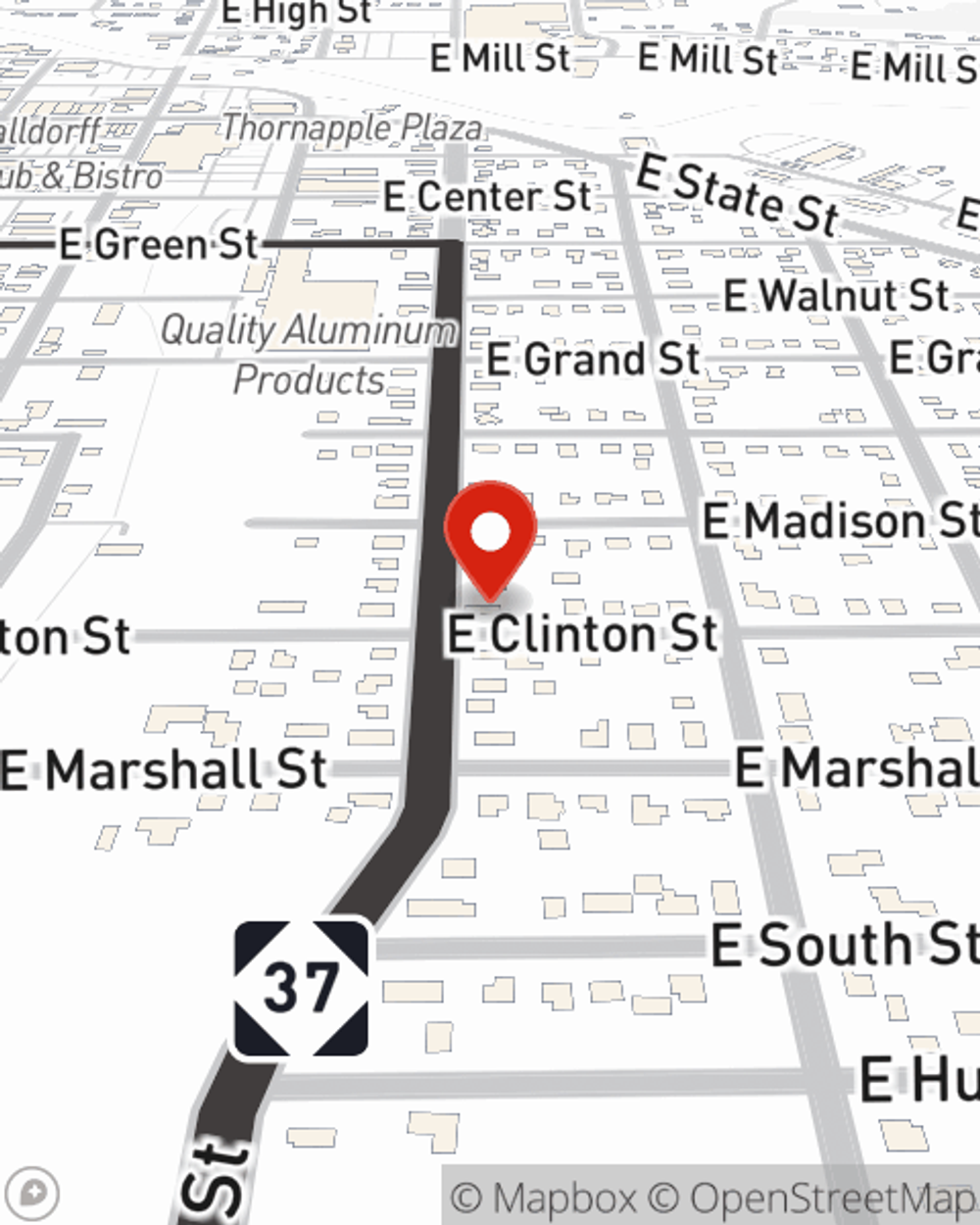

As a dependable provider of life insurance in Hastings, MI, State Farm is committed to be there for you and your loved ones. Call State Farm agent Tal Gearhart today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Tal at (269) 948-1284 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Tal Gearhart

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.